It is no secret that Aetna insurance in Florida is one of the top choices residents can make when they are trying to get health coverage.

In this article, you will learn the benefits, pros and cons, different plans, and much more about Aetna health insurance so you can make an informed decision about buying.

Should you go with an Aetna CVS Health plan in the sunshine state? Let’s find out more!

Some Aetna facts in the state of Florida

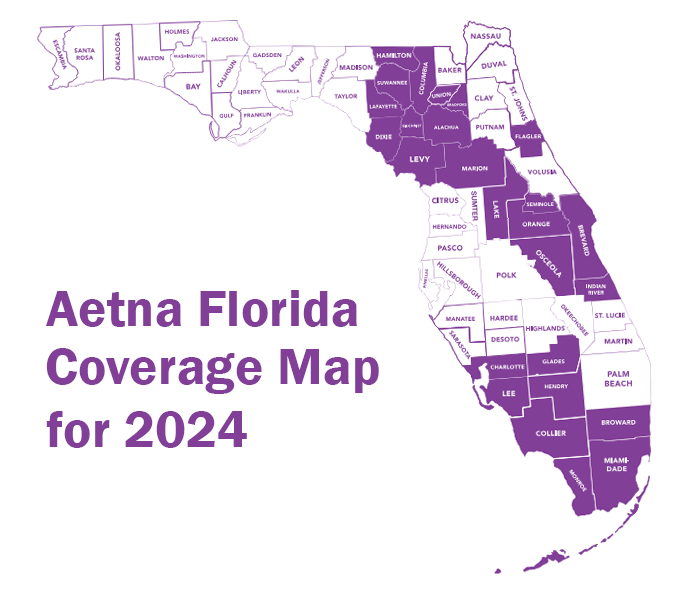

- Available in 26 counties in 2024.

- Offers rewards programs and discounts.

- No referrals needed to visit doctors in their HMO network.

Is there Aetna insurance in Florida?

Yes, there are many types of insurance that are offered by Aetna in the state of Florida. It is one of the most diverse companies in the sunshine state when it comes to coverage. Find out where it ranks amongst the best health insurance companies in Florida with our list we made.

In the state of Florida, Aetna offers health insurance, dental and vision, Medicare, life insurance, and disability insurance. Safe to say there is plenty to choose from. While there are many, this article will focus on the ACA plans (Obamacare) only.

What plans does Aetna have in FL?

While Aetna offers Health Maintenance Organization (HMO) and Exclusive Provider Organization (EPO) plans across the health insurance marketplace, in Florida, they only offer HMO plans. While it is a bit stricter it still provides great coverage as they have one of the largest networks of all the insurers.

HMO plans: Aetna HMO plans are a type of plan that only lets you get care inside the plan’s network. It will always be the cheapest option in the marketplace out of the 4 available (HMO, EPO, PPO, and POS). The key feature with an HMO is that you will usually need a referral to see a specialist doctor. According to their Resource Guide, you will not need to choose a primary care doctor (PCP) like other HMO plans.

Aside from that, Aetna offers 3 plan tiers in the Florida marketplace, which are bronze, silver, and gold plans. To keep things short, the lower the tier, the cheaper but the more it costs to get medical care. And the silver tier will have cost-sharing reductions that help you save money (if you qualify for a subsidy).

What will Aetna health insurance in Florida cover?

Aetna in Florida is no different from any other provider throughout the country when it comes to the main benefits that the Affordable Care Act law made mandatory. All the companies will provide you with 10 essential benefits + they will not be able to deny you coverage based on a pre-existing condition.

Aetna will cover you with the basics like doctor visits, emergencies, hospitalizations, prescription drugs, surgeries, mental health, pediatrics, and more. Aside from this they have rewards programs that offer you cash benefits for taking care of your health.

Another unique benefit to Aetna is their same day appointments through CVS Health. This is possible because CVS Health acquired Aetna and now are partnered making Aetna CVS Health. These are just the benefits of their Obamacare plans, if you decide to get any other type of service from them, it will differ.

Aetna insurance in Florida provider's map

As of 2024, Aetna is in 26 counties in the state of Florida, offering their HMO plans through Obamacare/ACA. Health insurers operate on a per county basis, so it is possible that they may not be available in your area. To see if they are in your area, check out our Aetna Florida provider map below. These are the following counties:

- Alachua

- Bradford

- Brevard

- Broward

- Charlotte

- Collier

- Columbia

- Dade

- Dixie

- Flagler

- Gilchrist

- Glades

- Hamilton

- Hendry

- Indian River

- Lafayette

- Lake

- Lee

- Levy

- Marion

- Monroe

- Orange

- Osceola

- Seminole

- Suwannee

- Union

The map above shows the current counties that Aetna operates in the state of Florida, in all these counties the only plans available will be their HMO (Health Maintenance Organization) network plans.

Pros & Cons of Aetna insurance in Florida

Aetna CVS Health has already proven to be a strong choice for Floridians, but it comes with its goods and bads just like every other insurer.

PROS

- Has same-day appointments through CVS MinuteClinic.

- Rewards programs with cash prizes.

- Strong HMO network.

- One of the cheapest plans in Florida.

CONS

- Customer satisfaction has mixed reviews.

- Bronze plans can be costly.

Overall, the pros outweigh the cons when it comes to Aetna, but it all comes down to everyone individually. Some people will have a positive experience while others may have negatives. The best way to find out if it is for you is to compare plans and see all your options.

Aetna reviews and ratings in the state of FL

Cuspide Rating

4/5 stars.

We gathered some of the ratings that were given out to Aetna in Florida to see what the overall score is. These were based on a lot of research from many different sources.

Forbes Advisor: 2.6/5 stars

Investopedia: 3.6/5 stars

BestCompany: 2.3/5 stars

USA Today: 4.6/5 stars

ValuePenguin: 4/5 stars

Insure: 3.7/5 stars

Overall, these reputable sources give Aetna around a 3.42 star rating out of 5. That is just slightly above average. The official score by the National Committee of Quality for Assurance to Aetna in Florida was a 3 out of 5 stars. It received 3.5 for customer satisfaction (average compared to other insurers) and got 2.5 for treatments. On top of that, they have an “A” rating from AM Best Rating.

It is important to do your own research and find out for yourself if Aetna is the company for you. Do not base everything off other people’s experience because everyone has different circumstances. And one company generally is not better than another.

How much does Aetna cost in Florida?

In Florida, an Aetna medical plan through the marketplace can cost you around $480 a month (without a subsidy). It all depends on your income, household size, location, what type of plan you choose and age to see how much you will have to pay a month.

In many counties throughout Florida, like Broward, Charlotte, Collier, Hendry, to name a few, the “Aetna Silver 5” plan is the cheapest option for the residents. Below is a chart that shows the difference in tiers.

| Avg Monthly Cost of Bronze Plan | Avg Monthly Cost of Silver Plan | Avg Monthly Cost of Gold Plan |

|---|---|---|

| $386 | $476 | $531 |

Data is based on a 40-year old buying a plan in 2024.

For those looking for cheap health coverage, Aetna will be one of the top insurers in the state with their competitive prices. Simply get a quote and see if they are the best choice for you.

Enroll in an Aetna CVS Health plan with Cuspide!

Compare plans, find doctors, make payments, and much more with our agents here at Cuspide. Give us a call at (305) 970-8583!

Should you choose an Aetna plan in Florida?

At the end of the day, whether you choose an Aetna plan in the sunshine state will be up to you. Start by figuring out your and your family’s needs since everyone is different. Always make sure to compare all the plans in the marketplace to see if they are right for you.

There is not one company that is better than the other because there are so many different factors that go into it. However, with its many benefits, great plans, low costs, Aetna insurance in Florida will always be a solid choice for the residents.

Share the post!