One of the finer choices of health coverage in the Lone Star State is an Aetna Texas plan. Due to their low prices and quality plans, they are amongst the top in the marketplace.

In this article, you will learn everything about Aetna CVS Health like the many plans, costs, availability, benefits, and much more! That way you are ready to make the right decision.

Why should you choose Aetna? Are they any good? What are the benefits? We know you have a lot of questions, and we are here to answer them all. Let’s dive in!

Is there Aetna in Texas?

Yes, Aetna offers many health insurance plans in the state of Texas like the Affordable Care Act (Obamacare) and Medicare. Not only do they have these, but they are also one of the leading providers in the state. They also have plans for employers and offer dental products as well. This article will be focused on the individual and family plans that Aetna offers in the state of Texas.

The Aetna Texas plans for 2024

In the state of Texas, Aetna offers individuals and families with many options when it comes to health coverage inside Obamacare. While they only offer HMO plans, they have the option of choosing different tiers. Let’s break it down.

HMO plans

While there are 4 types of plans in the marketplace, HMO, EPO, EPO, and POS, in the state of Texas, Aetna only offers HMO plans. Health Maintenance Organizations (HMOs) are the cheapest option out of the 4 and have the “least” flexibility. Their most notable feature is that members need a referral from their PCP to see a specialist. Also, you can only get care inside the plans network.

Bronze tier

Plans:

– Aetna CVS Bronze: $0 Walk-In Clinic Visits, Telehealth, Store Discounts

The bronze tier is the cheapest out of all and has the lowest monthly premiums but will have the highest cost when it comes time to receive medical care. This is best for those who don’t expect to use their plan frequently and want something for worst case scenarios.

Silver Tier

Plans:

– Aetna CVS Silver 1: $0 Walk-In Clinic Visits, Telehealth, Store Discounts

– Aetna CVS Silver 2: $0 Walk-In Clinic Visits, Telehealth, Store Discounts

– Silver 5: Aetna network of doctors & hospitals + $0 walk-in clinic + $0 Virtual Care options 24/7

– Silver S: Aetna network of doctors & hospitals + $0 walk-in clinic + $0 Virtual Care options 24/7

– Silver 7: Aetna network of doctors & hospitals + $0 walk-in clinic + $0 Virtual Care options 24/7

– Silver 6: Aetna network of doctors & hospitals + $0 walk-in clinic + $0 Virtual Care options 24/7

The silver plans are the most balanced tier in the marketplace because they have a nice mix of medical care costs and monthly premiums. They also include extra cost savings options which makes it the most popular in Obamacare. If you want normal out-of-pocket costs while not breaking your wallet monthly, they are the best choice.

Gold tier

Plans:

– Aetna CVS Gold: $0 Walk-In Clinic Visits, Telehealth, Store Discounts

– Gold 3: Aetna network of doctors & hospitals + $0 walk-in clinic + $0 Virtual Care options 24/7

– Gold S: Aetna network of doctors & hospitals + $0 walk-in clinic + $0 Virtual Care options 24/7

– Gold 4: Aetna network of doctors & hospitals + $0 walk-in clinic + $0 Virtual Care options 24/7

The gold tier is best for those who expect frequent medical care and do not mind paying a little extra for the low medical costs. They will be the most expensive plan behind the platinum tier (which Aetna does not offer) in the marketplace.

What do Aetna plans cover in Texas?

Just like any other company, they are legally required to offer the 10 essential health benefits. In Texas, Aetna will cover the following services:

Emergencies

Ambulatory patient services

Maternity/newborn care

Hospitalization

Mental health services

Prescription drugs

Pediatrics

Laboratory services

Preventive care

Rehab/habilitative care

However, what sets Aetna apart is that they have their own unique benefits which some other companies do not. But what exactly are they? Let’s dive in

Aetna plan benefits

The most popular features of Aetna plans are their $0 cares like the following:

– $0 Virtual Care

– $0 Preventative Care

– $0 In-network walk-in clinics

On top of this they offer the best prices on prescription drugs with many plans having a $5 copay or less for medicine. Aetna members will also get $100 yearly allowance to use for over-the-counter health and wellness items at CVS stores.

One of the most notable features is Aetna’s CVS MinuteClinic care. You can get same-day care through it because many are open 24/7. These will usually include the $0 care. Below are some of the services that MinuteClinic includes:

- Allergy treatments

- Vaccines

- Illness & infections

- Women’s health and more

As you can see, they have a lot of extra benefits that are unique to Aetna only which is why it is one of the most popular health plans in the state. So, are they available in your area? Let’s find out more.

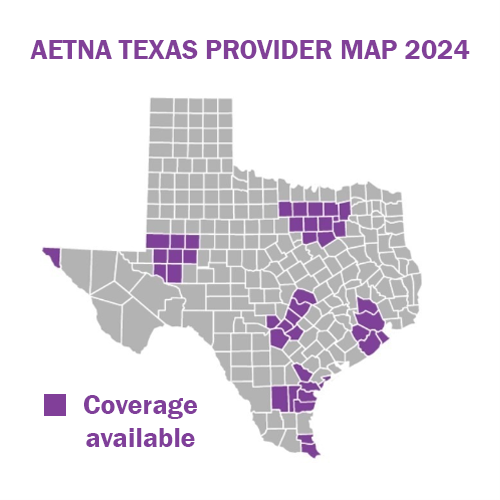

Aetna Texas provider map 2024

In the Affordable Care Act, companies offer plans based on counties. While Aetna is in the state of Texas, they may not be in your specific county. Below are the locations of coverage.

As of 2024, Aetna is in the following 41 counties in the state of Texas:

Andrews

Aransas

Bee

Bexar

Brazoria

Cameron

Collin

Comal

Crane

Dallas

Denton

Duval

Ector

Ellis

El Paso

Fort Bend

Galveston

Glasscock

Guadalupe

Harris

Hays

Howard

Hunt

Jim Wells

Johnson

Kaufman

Kendall

Kleberg

Martin

Midland

Montgomery

Nueces

Parker

Rockwall

San Patricio

Tarrant

Travis

Upton

Willacy

Williamson

Wise

If you see your county, that means Aetna is available to you and your family, if not, try and find another company. Also, depending on the county there will be different tiers available and different coverage.

What hospitals accept Aetna in Texas?

Aetna has a strong reach of providers across the state. Below is a list of hospitals that accept Aetna based on the major cities. Based on the Aetna website directly, these are the networks that are included but not limited to:

Austin

Heart Hospital of Austin

North Austin Medical Center – HCA Affiliate

Round Rock Medical Center – HCA Affiliate

St. David’s Georgetown Hospital – HCA Affiliate

St. David’s Medical Center

St. David’s South Austin Medical Center

St. David’s Surgical Hospital

Corpus Christi

Corpus Christi Medical Center – Bay Area

Corpus Christi Medical Center – Doctors Regional

Corpus Christi Medical Center – Northwest Behavioral Health Center

Corpus Christi Medical Center – The Heart Hospital

Dallas

Medical City Hospitals (HCA)

Methodist Hospital System

El Paso

Las Palmas Del Sol Healthcare

HCA Del Sol Medical Center

Houston

Bayshore Medical Center – HCA Affiliate

Brazosport Regional Health System

CHI St. Luke’s Health Baylor College of Medicine Medical Center

Clear Lake Regional Medical Center – HCA Affiliate

Conroe Regional Medical Center – HCA Affiliate

Cypress Fairbank Medical Center Hospital

Houston Northwest Medical Center

Kindred Hospital – Houston Northwest

Kingwood Medical Center – HCA Affiliate

North Cypress Medical Center

A Campus of Kingwood Medical Center

Park Plaza Hospital

Pearland Medical Center – HCA Affiliate

St. Luke’s Hospital at the Vintage

St. Luke’s Lakeside Hospital, LLC

St. Luke’s Patients Medical Center

St. Luke’s Sugar Land Hospital

St. Luke’s The Woodlands Hospital

Sugar Land Cancer Center

Sugar Land Medical Center

Texas Orthopedic Hospital – HCA Affiliate

Tomball Regional Medical Center

West Houston Medical Center – HCA Affiliate

Woman’s Hospital of Texas – HCA Affiliate

Midland/Odessa

Medical Center Hospital

Midland Memorial Hospital

Rio Grande Valley

TENET

Valley Baptist Brownsville

Valley Baptist Harlingen

San Antonio

Methodist Ambulatory Surgery Hosp NW-HCA Affiliate

Methodist Children’s Hospital of S. Texas-HCA Affiliate

Methodist Hospital – HCA Affiliate

Methodist Hospital South

Methodist Specialty and Transplant Hospital – HCA Affiliate

Methodist Stone Oak Hospital-HCA Affiliate

Methodist Texan Hospital – HCA Affiliate

Metropolitan Methodist Hospital – HCA Affiliate

Northeast Methodist Hospital – HCA Affiliate

University Health System

Pros and Cons of Aetna Texas plans

Is an Aetna plan for you? Explore the good and the bad below.

PROS

- Access to same day appointments with MinuteClinic

- High AM Best Rating of “A”

- Above average customer satisfaction

- Many $0 services

CONS

- Only HMO plans are offered

- No dental coverage included

Reviews for Aetna health insurance in Texas

Overall, Aetna is viewed in a slightly positive way. It is not uncommon for health insurance companies to get bad reviews altogether so be careful when taking reviews into mind. Below are the official 5-star ratings from different sources to Aetna:

Cuspide

ValuePenguin

Investopedia

3.5 stars

Official NCQA rating

“A”

AM Best rating

As you can see, Aetna is a solid choice for health coverage with the average rating being around 4 stars. It also received a 3.5 from the NCQA (National Committee of Quality Assurance) and an A rating from AM Best, which is the second highest rating. You can rest assured that you are safe in their hands.

How much do Aetna plans cost in Texas?

Aetna has one of the lowest rates out of any health insurance company in Texas. Investopedia gave it the award for “best premiums” and ValuePenguin has it as the cheapest option in the state of Texas at around $519 a month.

Price depends on many factors like income, household size, age, location, and more. But on average, Aetna plans cost around $513 a month without a subsidy. That is for a silver plan in the marketplace. This makes it the cheapest option on average out of every other company.

Where does Aetna rank in the Lone Star State?

According to our detailed ranking of the best health insurance companies in Texas, Aetna ranks as the 3rd best health insurance company in Texas. Checkout the rankings here. We gave them a solid 4.4 out of 5 stars. They also ranked as the “best for affordability” with many of their plans appearing as the cheapest option for Texans.

We based our rankings on many factors like availability, types of plans offered, costs, official NCQA ratings, and much more. There are over 15 different health insurance companies in the Texas marketplace, so a 3rd place ranking is great! It is a solid choice for health coverage.

Enroll in Aetna Texas plans

Explore the many Aetna plans available by calling (305) 970-8583. Save money, find doctors, make payments, and more with Cuspide!

Frequently asked questions

Don’t see your question or have a specific one? Call (305) 970-8583.

How do I contact Aetna in Texas?

There are a few ways to contact your health insurance provider. What members must know is that the contact number for their insurance will always be on their card. However, if you need to reach Aetna, you can call 1-800-213-3224. You can also reach out to us at (305) 970-8583 because we work closely with Aetna and can help with anything you may need.

Why should I choose Aetna health insurance in Texas?

There are many reasons as to why people choose an Aetna CVS Health plan in the Lone Star State. For starters, Aetna usually has the lowest cost plans in the state. On top of that they have unique benefits like same day appointments through MinuteClinic. Many $0 services for things like virtual visits, preventative care, etc. Also, they have a decent rewards program that offers cash prizes.

How do I qualify for an Aetna Texas plan?

Like any other company inside Obamacare, you must meet certain requirements to apply. For starters, health insurance plans through the marketplace are based on income. Your household needs to meet a certain minimum to qualify (depending on how many people are in your tax household). If you are a resident of the United States and meet the income requirements, you can apply for an Aetna plan in Texas. As always, give us a call and get a quote at no cost to you.

The bottom line...

While there are many health insurance companies to choose from in the Lone Star State, you now know that Aetna is amongst the top. Their low prices, large network, and plans make it a fine choice.

Before you go make a decision, it is important to speak to a licensed broker who can show you all the options in the marketplace. That way you do not miss out on a potential gold mine that was perfect for you in terms of price and coverage.

However, if an Aetna Texas plan happens to be the best choice, you can rest assured that you are in good hands because they are one of the best companies in the nation.