While there are many to choose from, Ambetter Insurance in Texas is one of the most popular options out there in the marketplace.

From there cash rewards programs to their affordable prices and types of plans available, there are many reasons to choose them over others.

This article will dive into everything you need to know about Ambetter Texas. Should you choose them? Are they good? Let’s learn more.

What is Ambetter Texas?

Known by their official name in the marketplace as Ambetter from Superior HealthPlan, they are a health insurance company that offers health insurance plans through the Texas Marketplace. They are a part of the well-known Centene Corporation. Known for their affordability and great coverage, they have been one of the leading health providers in the Lone Star State since 2014.

The benefits of Ambetter Insurance in Texas

Like all the companies inside the Affordable Care Act, Ambetter is required by law to provide the 10 essential health benefits to their members. This includes services like:

– Ambulatory care

– Hospitalization

– Prescription drugs

– Maternity/newborn care

– Rehab

– Pediatrics

– Emergency services

– Laboratory

– Preventive/wellness care

– Mental health/substance abuse

While these are the standard benefits they must provide, Ambetter also has specific benefits for their members that are unique to them. For example, the “MyHealthPays” rewards program that gives cash prizes for those who take care of their health. They also have a 24/7 nurse line and offer dental, and vision plans for their clients.

Aside from that they have their online portal where you can make payments, view plan benefits, and order ID cards. You can also schedule appointments directly through the website. Mothers can also find direct support through their “StartSmart for Your Baby Program”. Members will also receive support for any chronic illnesses, behavioral issues, and much more.

What are the types of Ambetter plans in Texas?

To understand the types of plans available, you must first understand the terminology and how plans inside the marketplace work. In Texas, Ambetter has 2 plans out of the 4 types, and they are HMO and EPO. Both are different and are made for everyone’s needs and budget.

Also, every plan has metal tiers like bronze, silver, gold, and platinum. The higher the tier, the more you pay a month and the less your care costs. In Texas, Ambetter only has silver and gold tiers. Let’s break down each plan and tier to see which one suits you the best and how they differ.

HMO plans

The most basic plan inside the marketplace are HMO (Health Maintenance Organization) plans. They require you to select a PCP and have them give you referrals to see a specialist doctor. With an HMO plan, you can only get care in your plan’s network (care outside network is not covered). HMO plans are the cheapest option out of the 4 types in the marketplace.

EPO plans

The more flexible option that Texans have are EPO (Exclusive Provider Organization) plans. These are popular because they do not require a PCP and allow members to see specialists without referrals. However, just like an HMO, you can only get care in-network. EPO plans will be more costly than an HMO plan.

Ambetter SILVER

Overall, silver plans have the best bang for your buck. They are perfectly split in the middle between monthly premiums and medical costs. For those who also have the extra cost savings options, silver plans will be the best choice. Great for those who:

- Want a reasonable monthly premium.

- Don’t expect frequent medical care.

- Like relatively low out-of-pocket costs.

Plans available in the silver tier:

- Complete Silver

- Clear Silver

- Focused Silver

- Standard Silver

- Complete Silver + Vision + Adult Dental

- Standard Silver + Vision + Adult Dental

- Focused Silver + Adult + Adult Dental

- Clear Silver + Vision + Adult Dental

- Ambetter Virtual Access Silver (Virtual PCP selection required)

- Standard Ambetter Virtual Access Silver (Virtual PCP selection required)

- Complete VALUE Silver

- Clear VALUE Silver

- Focused VALUE Silver

- Standard Silver VALUE

Ambetter GOLD

For those who want to invest a little more in a health plan, the gold tier is a great place to go. While the monthly premiums will be higher, when it comes time to receive medical care, the costs will be lower. Great for those who:

- Expect frequent or ongoing medical care.

- Want to trade higher premiums for lower costs.

- Are on the upper side of the income bracket.

Plans available in the gold tier:

- Complete Gold

- Everyday Gold

- Clear Gold

- Standard Gold

- Complete Gold + Vision + Adult Dental

- Standard Gold + Vision + Adult Dental

- Everyday Gold + Vision + Adult Dental

- Clear Gold + Vision + Adult Dental

- Ambetter Virtual Access Gold (Virtual PCP selection required)

- Standard Ambetter Virtual Access Gold (Virtual PCP selection required)

- Everyday VALUE Gold

- Standard Gold VALUE

Ambetter VALUE

Ambetter’s VALUE Plans offer members cost-effective healthcare coverage, which are designed to work with specific providers and hospitals. You will be assigned a PCP within a designated Medical Group who will manage your healthcare needs. These plans require referrals for most services that your PCP cannot provide, such as visits to specialists. Just like other plans you will have access to prescriptions, lab tests, imaging services, and any specialist.

The VALUE plans are best for:

- Those who don’t mind needing referrals to see specialists.

- Want $0 virtual copays.

- Do not have a specific PCP in mind.

Ambetter VALUE plans are in the silver and gold metal tiers and are only available in the following counties:

- Bexar

- Collin

- Dallas

- Denton

- Fort Bend

- Harris

- Montgomery

- Rockwall

- Tarrant

- Travis

- Williamson

Find affordable health plans with Cuspide

Did you know that our average client pays only $40 a month for their health insurance? Stop waiting and join them! Call us at (305) 970-8583 and save money, find doctors, make payments, and much more with Cuspide!

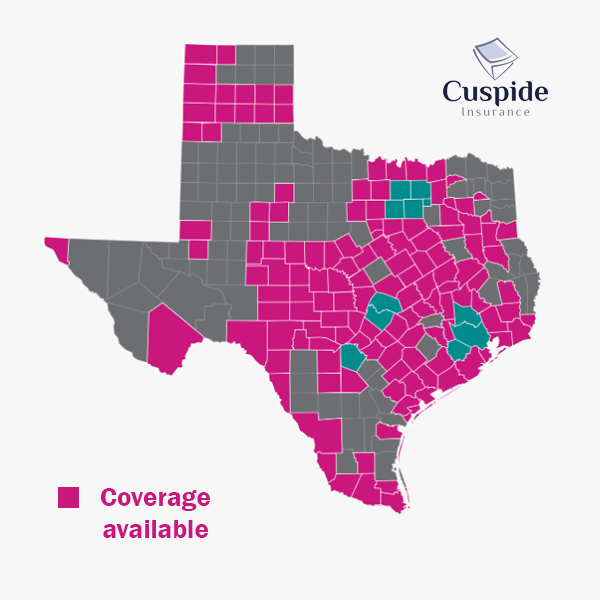

Ambetter of Texas Coverage Map

For those wanting coverage they should not have a problem with availability. As of 2024, Ambetter is in 149 counties in the state of Texas. It is important to know that marketplace coverage is based on a county basis. Check the picture or read below to see if you find your county.

Counties available:

Andrews

Aransas

Armstrong

Atascosa

Austin

Bandera

Bastrop

Bell

Bexar

Blanco

Bosque

Brazoria

Brazos

Brewster

Brooks

Brown

Burleson

Burnet

Caldwell

Calhoun

Cameron

Camp

Carson

Castro

Chambers

Cherokee

Coke

Coleman

Collin

Collingsworth

Colorado

Comal

Comanche

Concho

Cooke

Dallam

Dallas

Deaf Smith

Delta

Denton

DeWitt

Donley

Ector

Edwards

El Paso

Ellis

Falls

Fannin

Fayette

Fisher

Fort Bend

Freestone

Frio

Galveston

Gillespie

Goliad

Gonzales

Gray

Grayson

Gregg

Grimes

Guadalupe

Hamilton

Hardin

Harris

Hartley

Hays

Henderson

Hidalgo

Hill

Hood

Houston

Hunt

Irion

Jack

Jackson

Jefferson

Johnson

Kendall

Kerr

Kimble

Kinney

Lampasas

Lavaca

Lee

Leon

Liberty

Limestone

Llano

Madison

Mason

Matagorda

Maverick

McCulloch

McLennan

Medina

Menard

Milam

Mills

Mitchell

Montague

Montgomery

Nacogdoches

Navarro

Nueces

Oldham

Orange

Palo Pinto

Panola

Parker

Parmer

Potter

Rains

Randall

Real

Refugio

Robertson

Rockwall

Runnels

Rusk

San Jacinto

San Saba

Schleicher

Scurry

Sherman

Smith

Somervell

Starr

Sterling

Stonewall

Sutton

Tarrant

Tom Green

Travis

Trinity

Tyler

Val Verde

Van Zandt

Victoria

Walker

Waller

Webb

Wharton

Wheeler

Willacy

Williamson

Wise

Wood

Zapata

What hospitals accept Ambetter in Texas?

In Texas, Ambetter is accepted by many top hospitals like the Memorial Herrmann Health System, Texas Health hospitals, St. Lukes, and many more. There are too many to list, but they have a large enough network to where it shouldn’t be heard to find covered services. For the full list of the hospitals accepted check out this PDF file.

How much does Ambetter cost in Texas?

What you or your family will pay monthly in health insurance comes down too many factors like age, income, location, and household size. It also comes down to how much subsidy (premium tax credits) you will receive to help pay for your plan. On average, Ambetter costs around $590 a month without a subsidy in the state of Texas.

This is based on an individual or family who is making more than 400% of the Federal Poverty Level. It is important to note that the monthly premium will be different for everyone. Get an accurate estimate with us at Cuspide at (305) 970-8583, and no charge to you!

The Pros & Cons

Cuspide Rating: 4.2/5 stars

The good

The bad

- Affordable plans to choose from

- Good variety of HMO and EPO

- 24/7 nurse line

- Cash rewards program

- Average customer service rating

- Slight difficulty in finding providers

Where do they rank in Texas?

According to our list made at Cuspide, Ambetter ranks as the 4th best health insurance company in Texas. Overall, it receives a 4.2 out of 5 stars for their availability, pricing, benefits, and more. It was awarded “best for prizes” by us because it gives their members unique rewards. It also has some of the most affordable plans in the Lone Star State which makes it rank highly.

Frequently asked questions

Have specific questions? Contact Cuspide at (305) 970-8583.

Do I need referrals with Ambetter Texas plans?

To see if you need a referral or not you must first find out which type of plan you have. If you have an Ambetter HMO plan, you will need a referral to see a specialist. However, an Ambetter EPO plan means that you can see a specialist doctor without needing to go through your PCP first. You can check this by looking at your member ID card or asking your insurance agent. Need help? Contact us at Cuspide.

Is Ambetter good in Texas?

Yes, Ambetter Texas plans are some of the best health insurance coverages you can get. This is because they have great prices, are accepted by many doctors and offer many unique benefits to their members. It ranks as the 4th best health insurance company in the Lone Star State according to Cuspide. If they happen to be in your area, getting coverage from them is a solid choice.

How do I sign up for Ambetter Texas?

To enroll in an Ambetter plan in Texas, you must do so through the health insurance marketplace. It can be tricky to navigate so we suggest finding the right insurance brokers to help you sign up. You will need to meet certain requirements to apply and have personal information ready. Call us at (305) 970-8583 to get help with enrolling. It’s as easy as 123.

Next steps...

For those looking for a decent affordable health plan now you know that Ambetter Insurance in Texas might be the choice for you.

If you enjoy good coverage, cash rewards for completing certain health tasks, and overall affordability, then it may be time to start enrolling with Ambetter.

While they are a solid choice, make sure you browse and compare all the plans available in the marketplace from all the companies, so you do not miss out on the ultimate deal.

SHARE!