The world of the Affordable Care Act (Obamacare) may be a little confusing which is why you must know how Premium Tax Credit works. This credit system began all the way back in 2014 and gave everyone a chance to have low-cost coverage. There’s a lot you must know about regarding subsidized health plans.

The worst thing that can happen are unwanted surprises (especially during tax season.) In this article, you will learn everything about ACA subsidies and how they lower your monthly premiums. This is the reason why the Affordable Care Act has the word “affordable” in it. As always, you can contact us here at Cuspide with any questions or if you want to enroll!

There is a lot of information here so if you prefer, jump between the topics that interest you more!

Navigate and Learn

Key Takeaways on Subsidies

4 out of 5 applicants will be eligible for Obamacare subsidies

A subsidy from the health insurance marketplace will lower your premiums

The credit you receive is reconciled at tax time, comparing your estimate vs actual income

As always, we made a detailed video on how health subsidies work. If you prefer video format instead of reading (we completely understand the visual learners) then check us out on YouTube at Cuspide Insurance!

What is a Premium Tax Credit and how does it work?

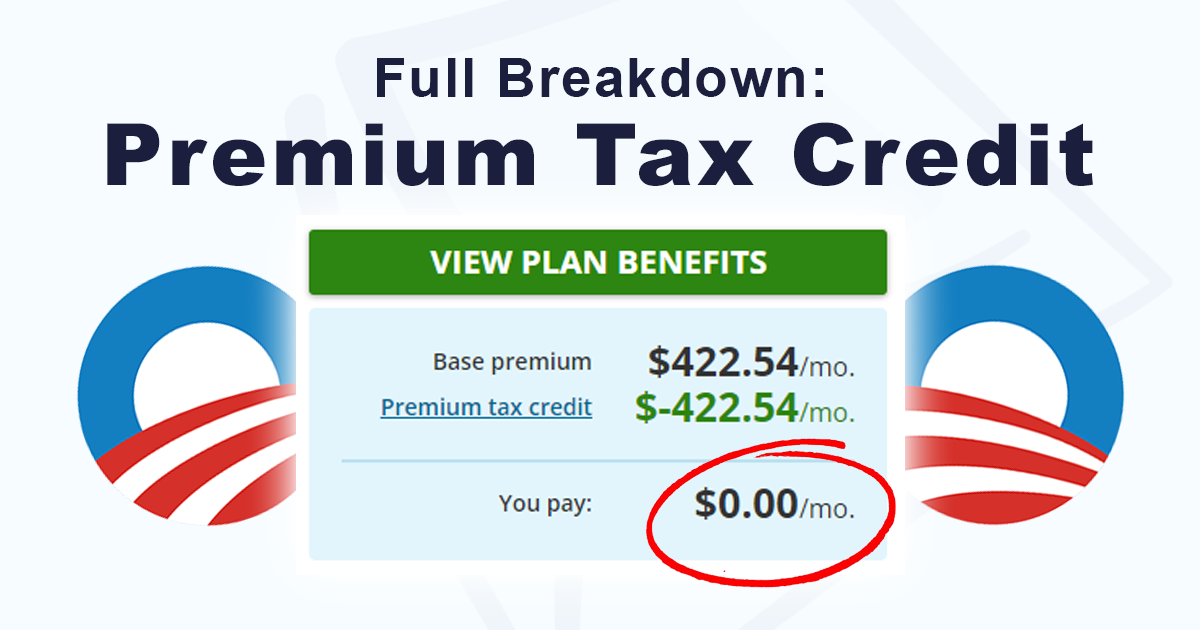

A Premium Tax Credit (PTC) is a subsidy provided by the United States government that helps individuals and families pay for their health insurance premiums. ACA subsidies are designed to make Marketplace insurance more affordable to those that are applying through the health insurance marketplace. This is what makes plans affordable, because without PTC, you would be paying the original price of a health plan (which can be thousands of dollars a month!)

It’s important to note that not everyone gets the same amount. (And some may not receive any subsidies at all.) Also, this only works if you enroll through a plan in the ACA marketplace. This does not apply to any other type of coverage. We will get into things like eligibility, how it works, and even what happens during tax season.

Who qualifies for Premium Tax Credit?

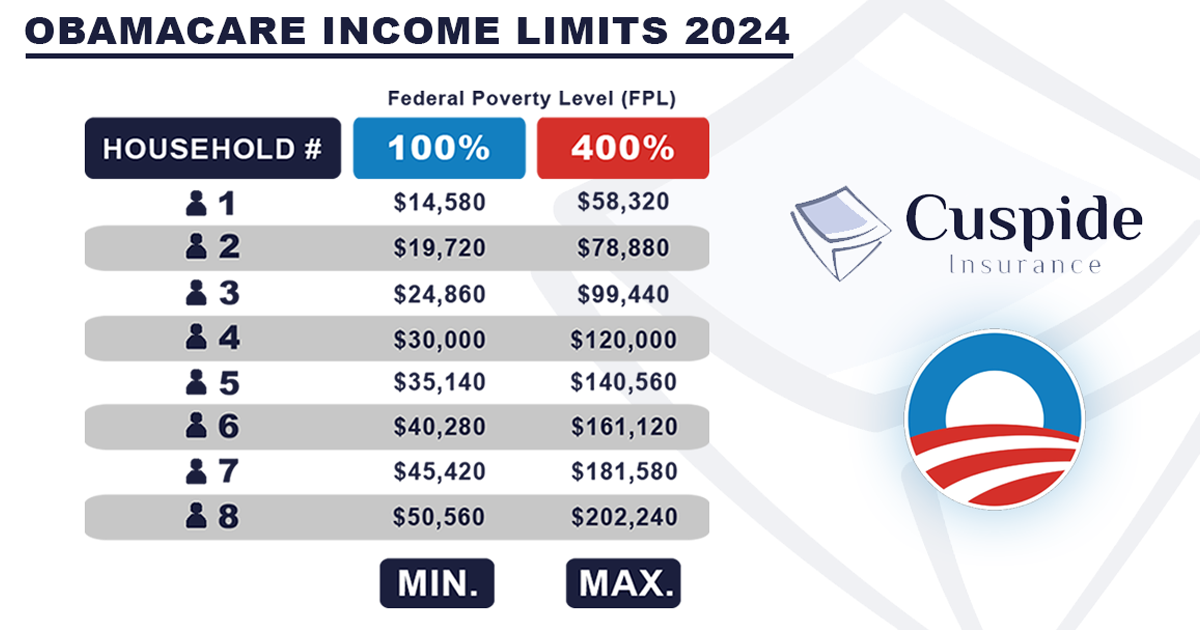

To qualify for Premium Tax Credit you must meet the minimum income requirement in Obamacare (ACA.) You must fall between 100% to 400% of the Federal Poverty Level (FPL) to qualify for subsidies. The closer you are to 100% the more tax credit you will receive. The closer you are to 400% the less tax credit you will receive. Also, the bigger your household, the more tax credit your family will receive.

Other eligibility requirements are that you must be a U.S. citizen or a legal resident of the United States. You must have social security or things like workers passport, employment authorization, green card, etc. If you have coverage through your job, then you can’t qualify as well as if you have Medicaid. You can always contact us here at Cuspide and we will help you to see if you can qualify for Obamacare subsidies.

ACA Subsidy Chart for 2024

Above are the Obamacare Income Limits for 2024. This chart will tell you the minimum and maximum income needed to qualify for subsidies. The first step you must take is figure out how many people there are in your household. This means everyone that will be reported at the end of the year in your taxes must be in the application (even if they are not getting coverage.)

For example, if you are a family of 4 (2 spouses, 2 kids) but only the spouses are getting coverage then the kids still must be part of the application process. So, to see your eligibility you must look at the family of 4 section which is $30,000 minimum income.

That’s why it is important to get as close as possible to your estimated income. Remember you enroll based on your adjusted gross income. For example, if you are self-employed and make $100,000 a year but after taxes you are left with $40,000 then you will apply for coverage based on $40k not $100k!

How do I know how much Premium Tax Credit I will get?

To find out how much subsidy you qualify for, you must find out how much money you will be making in the year. Next find out how many people are going to be in your application (household size). After that figure out if you will have any dependents filed in your taxes. (Dependents make you eligible for more tax credits.) Let’s go through 2 different example scenarios of real-life examples of how Obamacare tax credits work and how different incomes and circumstances affect what you will pay in premiums:

- Mary is a 30-year-old woman with 1 kid. She wants a health plan but only for her and not her child. She is making $30,000 a year. Mary applies for coverage through the ACA marketplace and receives $429 of premium tax credit. A silver plan (with the extra savings options) costs her $17/mo with $0 deductible and low copayments. Now if Mary applied by herself with no dependents, she would receive $375 tax credits this time around. The first silver plan with $0 deductible and low copays is now at $80/mo.

- Smith wants to apply for health insurance with his wife and kid. They all want coverage and the household in total is making $50,000 a year. Based on this estimated income they put, they will receive $1,230 worth of tax credits. They are around 200% of the Federal Poverty Level so they can expect to pay around $160 for a silver plan with a $0 deductible. Now if they were close or at the 100% level ($24,860 of annual income) they would get $1,316 per month of credit and pay around $11 for a $0 deductible silver plan. Now if they were past the 400% FPL then Mr. Smith and his family would pay around $400-500 a month.

Those were some examples of how ACA subsidies work when it comes to Marketplace insurance. Keep in mind that it is different based on everyone’s circumstances (income, dependents, location, age, etc.) To accurately figure out how many subsidies you will get contact an insurance agent/broker. Here at Cuspide our quotes are at no cost to you. We can help figure out ways to find affordable health plans for you and your family.

Ready to apply for ACA plans?

Contact us at Cuspide to get a free quote on your health plan. We will look through the whole ACA marketplace and find you the most affordable plan. We can help you through phone, text, or email.

Don’t wait and reach out to us at (305) 970-8583

What is Premium Tax Credit based on?

ACA subsidies are calculated on many different factors. It is determined mainly by the lowest cost silver plan (SLCSP) which we will get into but also other factors. So, below are the 3 different ways that health subsidies are calculated and determined:

The primary factor is the annual revenue of the household that is applying. It is designed more for individuals & families with lower income. The benchmark used is the Federal Poverty Level (FPL).

The size of your household (how many are inside the application) are considered. Generally, the larger the family, the more credits they will get. Remember that a household in insurance terms is the amount of people that will be reported in the taxes.

The cost of a benchmark health plan in your area, known as the Second Lowest Cost Silver Plan (SLCSP), is used to figure out the credit. This is the health plan in the silver category (there are Bronze, Silver, Gold, and Platinum plans). It is made to make coverage more affordable by putting a cap on the amount you are required to pay for your plan based on your income.

These are the main factors that affect how health insurance tax credits are calculated. Remember this is just based on the estimate. It is KEY to get as close as possible to your actual income so there are almost no differences when tax seasons comes around. To figure out the amount you can contact us at Cuspide.

How will I get my health insurance tax credit?

There are 2 options you can choose from when wanting to get subsidized health plans. You can either choose to get it in real-time through the advanced option (APTC) or you can choose to claim it at the end of the year. (Either get help paying your plan or don’t get any help at all.) If you choose real time, then you will get help paying your premiums monthly. If you pick the other, you will have to pay the plan outright for what it’s worth.

Advanced Premium Tax Credit (APTC)

This option makes health insurance more affordable every month. You get the credit in real time, so it is applied immediately. If you choose this option, you must carefully estimate your income for the year because if not then you may have to pay some of the difference back at the end of the year. If you qualify for subsidies, then this is the normal route to take. Lower your premiums monthly and then return at the end of the year if you must.

Will Premium Tax Credits affect my tax returns?

It can affect your tax return by reducing the amount of income tax that you owe. Or it can also affect your taxes by you needing to return some of the difference. This all comes down to estimated income vs actual income. When it is time to do your taxes, you will get a FORM 1095A from the health insurance marketplace that shows you your ACTUAL income and how much tax credit you should’ve received throughout the year. We will also help you with a solution as to how you can help fix this and get a more accurate income for the year. There are 2 scenarios that can happen with your ACA subsidies so let’s break them down:

What happens if you put LESS income than you made in your health insurance application?

If you underestimated your income when applying for coverage, you will have to return the difference in tax credits. What is the difference? How do you know? Let’s do the 2 different scenarios that will happen so you can avoid problems with the good old IRS:

For example: If you are 30-year-old male and in the application, you put you make $30,000 a year. Based on this income you will receive $358 per month of credit. However, when tax season comes around you realize that you made $40,000 and not $30k. This means that you should’ve received $248 of tax credit. So now what happens? You must now return the difference in tax credit, so you subtract $358 (estimated) minus $248 (actual) and it gives you $110. Now you get that and multiply that by the 12 months you got that credit which equals to $1,320. So, you will have to give back that amount if you put the incorrect income.

What happens if you put MORE income than you made in your health insurance application?

In the other hand, if you overestimated your income when you applied for Obamacare plans then you will either reduce what you owe in taxes or even get some money back. Like the other example, this one is the opposite.

For example: If you are a 30-year-old man and when applying you put you make $50,000 so you get $119 per month in tax credit. However, you made a mistake and you made $40,000 for that year. So, what happens now? Will you get penalized? Now when tax season comes around, they will calculate your actual income ($248 of credit) and subtract that from your estimated credit. $129 x 12 months = $1,548 that you can get back at the end of the year. Not a bad surprise!

Update your health insurance application

The best way to correctly report income and avoid any surprises in your tax returns is to constantly update your health insurance policy. Tell your agent/broker of any changes that have happened (income wise, adding/removing dependents, etc.) If you do this then at the end of the year the actual income will closely match the estimated income that you put in the application.

Can you apply for health insurance if you haven’t filed taxes?

Yes, you can apply for health insurance if you didn’t file taxes last year, but only if you will be filing taxes in the following year. Obamacare subsidies are based on projected income so if you will be filing taxes because you are currently working and haven’t done so in the past then you can still apply. As always, make sure you are getting as close as possible to estimating what your income will be.

What is the Form 1095-A used for?

The Form 1095-A Health Insurance Marketplace Statement is a form you receive that shows how much financial help (Tax Credit), you got to lower the cost of your health insurance plan during the year. It is important because it lets you know if you qualify for more credits (meaning you get money back/lower your taxes) or if you need to repay some of the help that you got back. In other words, it shows you what your actual income was and what you should have been credited throughout the year. The form 1095-A from the marketplace includes:

- Information about your policy

- The monthly premiums paid by you or your family

- Total tax credits used

- People in your household that were applying for coverage

- Monthly tax credits paid by you

What is Form 8962 in health insurance?

After you get Form 1095-A, you use it to complete Form 8962. This is the PTC form. It will help you figure out if you received the correct amount of credit during the year based on your actual income. Include Form 8962 with your tax return when you file federal income taxes to the Internal Revenue Service (IRS). The information will be used to reconcile the credit you received in advanced (APTC) with the amount you were eligible for based on your annual income.

Cost-Sharing Reductions in Health Insurance

Like ACA subsidies, Cost-sharing reductions (CSRs) are a type of financial help provided in health insurance plans to help lower your out-of-pocket costs. They will help lower payments for things like doctor visits, prescription drugs, medical care, etc. To qualify for this special reduction, you must fall between 100% to 250% of the Federal Poverty Level (check back to the income limits chart.) You must also know that CSRs are only available in the silver health plans in the marketplace. They give you an option which allows you to save more.

Extra savings option

When applying for a silver plan they will have the extra savings options. This refers to the cost-sharing reduction that you will receive if you select a silver plan. Inside a plan there are deductibles, out-of-pocket maximums, and copayments. The Extra Savings options will lower all this down so you can have a more affordable health plan. This is usually why the silver plans are the most popular in the ACA marketplace. Usually only appears for lower income households.

Premium Tax Credit and Cost-Sharing Deductions

You must know that Cost-sharing reductions and tax credits are not the same but more so work together. Part of the subsidies you get is the CSR option. The PTC lowers your monthly premium and reduces the overall amount you will pay for your health insurance. However, the CSR kicks in when you use the plan. Both are designed for individuals and families with lower incomes to make everything more affordable. Think of the PTC as a general thing for everyone and the CSR as something more specific to only a select few people.

Enroll in health insurance today with Cuspide!

Compare and choose from the many affordable health plans available in the ACA marketplace. Here at Cuspide we pride ourselves in always finding low-cost coverage options for our clients. Contact us via phone, text, or email today at (305) 970-8583! We look forward to helping you and your family!

Frequently asked questions

Cuspide answers the web’s most asked questions regarding ACA subsidies.

ACA subsidies are a good addition to the Affordable Care Act because they make health insurance affordable. Without it, you are stuck paying hundreds to thousands of dollars a month for a medical plan. Some people may find it “bad” because it is a bit difficult to understand. If you have fluctuating income, it is important to constantly update your application so there are no problems during tax returns. However, if you are a low-income family then Obamacare subsidies are a great addition to the health insurance world. If you want to know if you are eligible contact Cuspide today at (305) 970-8583.

To see if you are qualifying for a subsidy, you must check your household income. Find out how many people are reported in your taxes and the total yearly income. If you are legal residents of the United States and stay with the 100-400% of the Federal Poverty Level, then you will receive subsidies. Obviously, the more money you make the less help you will receive to pay your monthly premiums and vice versa. Just because you are outside of the income limits doesn’t mean you can’t apply for health insurance. It just means that you will not get any credit to help you pay for your health plan.

Yes, Obamacare (ACA) can lower your tax returns but only if you overestimated your income for the year. If your household income inside the application was set at $50,000 but at the end of the year your adjusted gross income was $40,000 then yes, you will get some money back because you should’ve gotten more tax credit, but you didn’t. That is the only reason why you will lower your tax returns. It is important to correctly estimate your income so there are no surprises later. Also, be careful because on the other hand, you can incorrectly put your income in and end up having to give back money. Contact an insurance agent/broker like us at Cuspide to help!

If you don’t want to pay back your ACA subsidies at the end of the year, then you must correctly put your income when applying for health insurance. You are only paying back money because you underestimated your yearly income when enrolling. (Meaning you put less than what you made.) For example, if you get a $300 tax credit when applying and you find out you should’ve gotten only $200 then you will have to return the difference. (300-200 is 100. Multiply that by 12 months and you get $1,200 that you must pay back.) The best way to avoid this is by updating your application when circumstances change. That way there is less of a difference between estimate vs actual.

The max income for ACA subsidy in 2024 is $58,320 for a single person. The minimum for a single person is $14,580. The Obamacare income limit for a family of 4 is $30,000 (the minimum.) And for a family of 2, the minimum income is $19,720. What happens if you are over the max income limit? If you are over, then you will not receive subsidies. However, you can still apply for coverage. Make sure you find out how you get paid (1099 or W-2 employee) so when you enroll in a health plan it is accurate. Also contact Cuspide to find out how much you will be eligible for.

The next steps to take

If your goal is to save money on health insurance, then getting Premium Tax Credits is a must. There are a couple of things that you need to keep in mind. Number 1 is that you must correctly estimate your income when applying. Find out how much your household in total is going to make. Number 2 is figure out if you are going to put any dependents in your policy. And number 3 is finding the right insurance broker because they will also help you save money. If you contact us at Cuspide you can save money because we can sell to ALL, the companies in the ACA marketplace. Unlike some others, who can only sell certain ones. Finally, be prepared for the tax returns. Depending on your circumstances you may either get some money back or must pay some back.

How Cuspide can lower your health insurance premiums

When it comes to getting health insurance finding the right insurance agent/broker is key. There are a couple ways you can enroll in a health plan and get subsidies but there is only one correct way. Some people contact the insurance company directly, which is a bad idea because you are missing out on the many other companies who may have more affordable plans that suit you better. Others may contact an agent that only has limited companies. That’s why you should contact Cuspide!

Hi, my name is Carlos and I started Cuspide Insurance in 2023. We have a small but might roster of the top insurance agents in the nation. Near the beginning of the Affordable Care Act, we were already helping customers with finding low-cost plans. Our main goal is to get everyone the affordable coverage that they deserve. We provide services like finding you doctors, making payments, changing plans, and more. If you want to see if you are eligible for Obamacare subsidies, then contact Cuspide today!

SHARE!