Short term life insurance policies can be a great tool that helps you protect not just your family but you as well. Whether you are looking to get your feet wet, fill a coverage gap, or have littles ones that rely on you, short term policies will get the job done.

In this article we go in depth into everything regarding short-term policies and why they are one of the best life insurance choices. Learn how they work, the target audience, costs, benefits, and much more with our detailed guide.

Are these policies for you? Why should you get them? Let’s dive in and answer all your questions and doubts.

What is short term life insurance and how does it work?

Short term life insurance is a type of life insurance policy (Term Life) that typically lasts between 1 to 10 years. It is designed to cover an individual for a limited period, usually for the purpose of temporary coverage, job change, covering loans, and more.

Short term policies usually start at a length of one year and can go up to 10. Many of these policies do not require a medical exam, allowing for an easier application process and approval. Because the coverage is short, the premiums are much less than a traditional policy. And, just like a normal policy, if the insured passes away, the beneficiaries will receive the death benefit.

How it works

Application starts by filling out a few health questions and coverage usually begins within a few days. You can either choose to pay monthly or annual premium payments in exchange for coverage. Once the term ends, the coverage expires, and if there is no death, no payout occur. Some policies can be converted to a longer-term plan at the end of its cycle.

Does short term life insurance have living benefits?

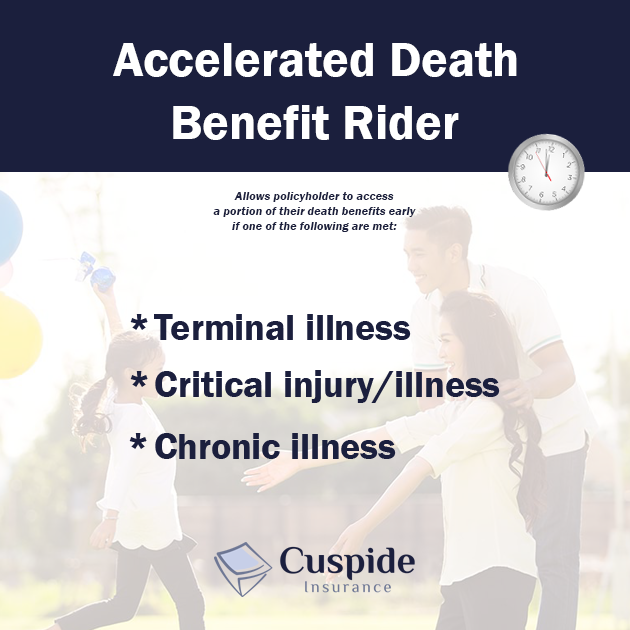

The most common life insurance myth is that the insured only receives money if they pass away, and that is NOT TRUE! Most short-term life insurance policies come with living benefits which allow the insured to use the money while they are still alive.

The term policies offered here at Cuspide come with Accelerated Death Benefits Rider (ABRs) which are optional and no additional cost features that allow you to get some of the death benefit in the event of a qualifying terminal illness, critical illness or injury, and chronic illness. Let’s learn more.

Critical illness and critical injury

This add-on allows you to receive a portion of the death benefit if you are diagnosed with a certain critical condition (heart attack, cancer, stroke, etc) or if you received a major critical injury

Terminal illness

If you are diagnosed with a terminal illness (in which you have 6-12 months left to live) these policies will pay out a portion of the death benefit while you are still alive.

Chronic illness

If you find yourself chronically ill, where you need help completing 2 out of the 6 daily activities (like eating, dressing, showering, etc) you will qualify to receive the death benefit from the term life policy.

It is important to note that not all companies will offer the Accelerated Death Benefit rider so look around and compare all the different policies. Here at Cuspide, we work with the top life insurance companies that do offer their best. Contact us at (305) 970-8583 for more information.

Who is it best for?

Keep in mind that these policies are not for everyone. They fill out a specific need and are made for a select group of people. Short term life insurance is usually best for those with temporary needs, people on budgets, individuals that need to repay loans or debt, or young adults. Let’s explore each one.

Individuals with temporary needs

The term policies offered here at Cuspide come with Accelerated Death Benefits Rider (ABRs) which are optional and no additional cost features that allow you to get some of the death benefit in the event of a qualifying terminal illness, critical illness or injury, and chronic illness. Let’s learn more.

Those on a budget

For those that want some sort of protection and don’t want to break their wallet, a short-term life insurance policy is a great choice. Due to the coverage being temporary and the term having a short duration, it will be cheap. For example, a healthy 40-year-old can grab a $100,000 policy for around $20 a month or less!

Repaying mortgage/loan

Those with a loan or debt can pick up a short-term policy that will provide coverage that aligns with the timeframe when the debt will be paid off. If something happens during that time period, your debt will be covered by the life insurance policy, protecting your family or estate from that burden.

Young adults

The best time to pick up a life insurance policy is when you are youngest (so right now). Those in their early 20s or 30s will be relatively health and have fewer financial responsibilities. Whether you are starting college or have a family, now is the time to grab that policy for hundreds of thousands of dollars in coverage.

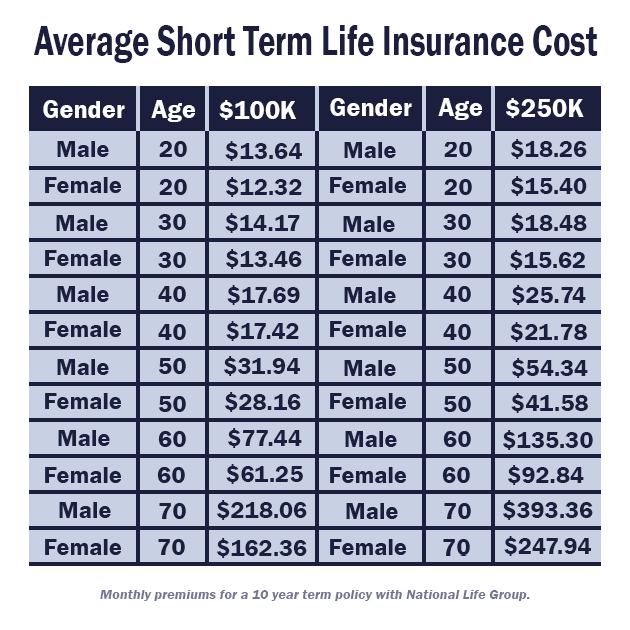

Average cost of short term life insurance

Short term life insurance ranges anywhere from $10 a month for a 1-year policy to around $20 a month for a 10-year policy. What you pay in premiums depends on several factors. Your age, health status, coverage amount, and length of the term will all affect the premium price.

Age

Age is one of the most important factors when it comes to premiums. The younger you are, the less you will pay because you are relatively healthier. For example, a 20-year-old will pay significantly less for the same term length as a 50-year-old.

Health status

If you are in good health with no medical issues, your premiums will be lower. However, those with certain conditions will pay a little extra for the added risk. Insurers will typically look at medical history, weight, and smoking habits. The healthier you are, the cheaper your policy will be!

Coverage amount

The amount of coverage you choose makes your policy either cheaper or more expensive. A policy with a death benefit of $500,000 will cost more than a policy with a death benefit of $100,000. This is simply because the insurer is assuming a larger payout risk.

Term length

The term length (from 1 to 10 years for this article) impacts the premium payment as well. Shorter terms will come with lower premiums because you are covered for less time. For example, a 30-year term will cost more than a 10-year term. The more you get, the more you pay.

The Pros & Cons

Like anything else in the world, these policies are better for some than others. Overall, it is a solid purchase as it lets you get a feel for how the life insurance world works all while financially protecting you at a low cost. Should you buy it? Is it for you? Let’s see.

The good

- Short term policies will be relatively cheap compared to a normal whole life insurance or long-term life insurance policies. Great for those on a budget who still want coverage.

- It has great flexibility allowing you to choose a specific time frame as well as coverage amount. For whichever short-term reason you need it for, it will have you covered.

- The enrollment process is quick and easy. No medical exams or blood tests. Answer a few questions and get approved.

- Some companies offer living benefits as well, allowing you to get some of the death benefit while you are still alive.

The bad

- Unlike traditional life insurance policies, these short-term policies do not build any cash value. You will not accumulate savings over time, it is a pure death benefit policy.

- The short-term length is very limited. Most companies do not offer a renewal or conversion with these shorter terms. Once it is up, it expires.

Best short term life insurance companies

Here at Cuspide we work with the top term life insurance companies like Mutual of Omaha, National Life Group, American International Group (AIG), and Foresters Financial. All these insurers have been around for over a hundred years and have no trouble with payout claims. If you want to get a quote at no cost to you, contact Cuspide at (305) 970-8583.

Mutual of Omaha

Founded: 1909

AM Best Rating: A+

Standard & Poor: A+

National Life Group

Founded: 1848

AM Best Rating: A

Standard & Poor: A+

American International Group

Founded: 1919

AM Best Rating: A+

Standard & Poor: BBB+

Foresters Financial

Founded: 1874

AM Best Rating: A

Standard & Poor: N/A

How to choose the right policy

In the world of life insurance, there are many companies out there offering different policies and it can get overwhelming. You must choose the right policy so there are no problems down the road. By figuring out needs, staying within budget, and comparing companies, you will find the right one. As always, the best advice is to contact an insurance broker (like us at Cuspide) to help you.

1. Figure out your needs

The first step you need to take is figure out why you need or want a policy. Maybe you have mortgage to pay off or some kind of debt, or you just started a family and want coverage during the growing stage. For example, if you have 10 years left on your mortgage payments, you get a 10-year policy to cover that timeframe with enough of a death benefit. Your wants and needs are the key to finding a great life insurance policy.

2. Determine your budget

Figure out how much you can comfortably spend without breaking your wallet on premiums each month. Try and find a balance between a decent coverage amount and premium payments. The good news is that short term policies are much cheaper than traditional ones. The premium payment should not bother you every time you have to make it.

3. Compare policies

Shop around and compare different policies from different companies. It is always best to contact an insurance broker as they have access to comparison tools. Look at coverage options, lengths, premiums and if they have any extra features like living benefits. Make sure the company is established and will have no problem paying claims! If the policy falls within your budget and fulfills your needs, it is time to pull the trigger.

Apply for short term life insurance with Cuspide

$100,000 in coverage starting at just $7 a month with Cuspide! Get access to the best policies in the marketplace. Call us at (305) 970-8583 for quotes at no cost to you!

Frequently asked questions

Have specific questions? Contact us at Cuspide.

What is the difference between short term and long term life insurance?

The difference between short term and long-term life insurance is the length of the coverage period. Short term is usually from 1 year to 5 (sometimes 10) and long term is anything past 10-year term, so 15, 20, and 30. Most long-term life insurance policies will have living benefits while it is rare to find 1-year policies that include living benefits. It all comes down to the specific needs of the person and what their goals are with a life insurance policy.

Can I convert short term life insurance to long term?

Usually, you will be able to switch from a short-term policy to a long term but that depends on the specific insurance company and their policy. Some policies include a conversion feature which allows you to switch to a longer-term plan or a permanent life insurance policy. There is a specific time frame when you can convert (usually 5 to 10 years) and you should expect to pay higher premiums. Also, not all insurers will have a conversion option.

What are the limitations to term policies?

There are many limitations to term policies. The first is the fact that it will expire and only provides coverage for a set period typically, 10, 20, or 30 years. Another limitation on term life insurance is the fact that it does not accumulate cash value. You are paying just for the death benefit coverage. And, while many term policies come with living benefits, there could be a limit on what they are. Lastly, there is a good chance there is no payout if the policyholder does not die.

Is short term life insurance good?

Overall, a short-term life insurance policy is a great choice for many reasons. It is a great way to get your feet wet in the life insurance world while not breaking your wallet. It is a tool that could be used as leverage for many different occasions. If you grab a 10-year term policy, it will come with living benefits and protect you and your family during an important time, all while being relatively cheap. It is a great choice depending on who you are and what your goals are.

Next steps....

Whether you want your debt to be paid off or have children who rely on you financially, short term life insurance is a great way to get protected. Do not wait and reach out to us at Cuspide for quotes at no cost to you.

For those on a budget who have temporary needs, these short-term policies are the key to a stress-free mind. Start by figuring out your needs and then browse around with an insurance broker to get the perfect policy for you or your family.

God forbid the worst happens; the policies offered by us come with living benefits so you can use the death benefit coverage while you are still alive. Short term life insurance is a great way to get protected without overexposing yourself financially. Take the first step today with Cuspide!

Share!