The last thing you want in your mind after beginning one of the most important stages in your career is to worry about your healthcare. So, to make things easy, we will show you how coverage works when you are in college, the requirements, options, etc. Welcome to the complete guide for student health insurance.

Key Takeaways

- You can stay under your parents’ health plan until age 26.

- Many colleges and universities require that students have some sort of health coverage.

- As a student you usually have access to more affordable plans and premiums.

Share!

Health insurance for students Overview

Do college students need health insurance?

As mentioned earlier, some universities will require that students have some type of coverage to even enroll. But aside from the requirements rule, it’s important to have some type of plan in place in case you need care.

You are young now and chances are you won’t use a plan much but, it happens time and time again, people always call asking for coverage when they are already sick, and it is too late. Don’t be that person! With many kids entering college with debt the last thing you want is to add more.

The good news is that there are many options you can choose from. And the best part is that since you are a student you will get the cheapest and best options that are out there. What are the different types of student plans? Which one is the best? Let’s figure it out.

If you are one of those that prefer to watch a video rather than read, then we have something for you as well. Watch this video by us at Cuspide explaining health insurance for students in detail:

Student health insurance coverage options

There are 3 main routes you can take when choosing a health plan for your university adventures. Having experience on both sides, we will try and guide you to the best choice. Here are the 3 options:

Your Parent’s Plan

A good way to get health insurance for students. You can stay under your parent’s policy until you are 26 years old. However, there are some downsides to this. For example, you can end up paying more when you need care because it is designed for them (stuff like doctor visits, copayments, etc.) Also, coverage may not be as good if you are out of network (going to a college out of state). Luckily, there is another option which we think is the best.

Individual & Family Plans

These are the normal plans that are offered through the health insurance marketplace. It is known as ACA or Obamacare. Mostly everyone in the United States has this type of coverage. The bread and butter of healthcare. This is our recommended route to take if you are a student and aren’t under your parents’ plan. This is perfect for those in college/university as incomes are low during these times and plans will be the most affordable. (90% chance you qualify for a free health plan.)

College/University Health Plan

The last option you can choose is directly from your university or college. Usually, campuses offer their students medical plans and are always affordable. The coverage is different for every school so it’s important to check with the school advisor. One downside to this is that it is usually very limited. You may only be able to use in-network providers and when you need care away from campus you won’t be able to.

Which one should you go with?

So now that you know all your options which one should you pick? Having experience from both sides, we will give you some advice. If you are a full-time student and aren’t working, then you can stick with your parents’ plan (if you are in the same state). If you are out of state, it may be best to go with your college plan.

However, if you are managing work on the side while attending college then it may be best to have a plan for yourself that suits you and your needs. The general rule in health insurance plans is that the less you make, the less you pay. This is perfect for students as they are at a time in their lives when they are earning the least. This all means that you will have the most affordable coverage possible.

Also, you can still apply for a health plan if you do not have a job. ACA plans (Obamacare) are based on projected income, so if you know you are going to get a job soon then it is best to apply so you aren’t without coverage for the meantime. So, figure out your circumstances and how your college years are going to play out and make a good decision for your healthcare. Which means you must know how everything works!

Now you may be wondering what this picture is and what is going on. This is what a plan looks like in the health insurance marketplace. There are lots of words here that you may not understand so let’s do a little breakdown so you can learn.

How does student health insurance work?

Student plans work exactly like the ones in the health insurance marketplace. It works by helping you pay for the care that you need (sharing the cost.) You pay a monthly amount (premium) to the insurance company and in return they help you pay for things like doctor visits, emergencies, surgeries, etc.

There are also many terms you must know. Things like deductible, out of pocket maximum, copayments, etc. Let’s go in depth so there aren’t any “surprises” later.

Premium

This is the payment you make to the insurance company in return for their help. It is what keeps your policy active (whether you use it or not.)

Deductible

This is the amount you will pay out of your own pocket before your insurance kicks in. That’s why we always pick our clients’ plans with $0 deductibles!

Copayment

A copay is a fixed amount that you will pay for a specific service or even medication. If you go to a doctor’s visit, then you can have a copay of $10 for that visit. It will usually be a small fee.

Out-of-pocket maximum

This will be the most that you will have to pay for covered services during the year. If you reach this limit your insurance will cover 100% of everything after. (Most likely you will never get near this number so don’t worry.)

These are the 4 main terms that you must know. There is more that you should learn as well. We dive deep into all the insurance terms so make sure to check it out. But what about the coverage? You don’t want to buy something that you have no clue what it is.

Apply for student health insurance

Take the first step in enrolling by contacting us at Cuspide. We will be your 24/7 insurance agents and help you with anything you may need. Make payments, find your doctors, etc. Don’t postpone your health and let’s get you enrolled.

What do these marketplace plans cover?

After the ACA (Affordable Care Act) law passed it made companies provide the Essential Health Benefits. This makes sure that you get the coverage you need. Here are the 10 benefits that companies must provide:

- Emergency care (ER visits, ambulance services, etc.)

- Outpatient care (Doctor visits, specialists, etc.)

- Hospitalization (Overnight stays, surgeries, etc.)

- Mental health services (Mental health & addiction treatments)

- Prescription drugs

- Rehab services

- Laboratory work

- Preventative care (Screenings, vaccines, etc.)

- Maternity and newborn care

- Vision and dental

Now you must know that because all of this is covered does not mean everyone is going to pay the same. All the insurance companies that exist will have different costs for all these services. (More on all the companies later.) For now, let’s focus on the enrollment process.

How to enroll in student health insurance

You can enroll in a plan through the marketplace. This is where you can compare and choose the best coverage for you. It is tricky to navigate if you don’t know what you are doing so it’s best to contact an insurance agent to help you out. Trust us, it’s easier that way.

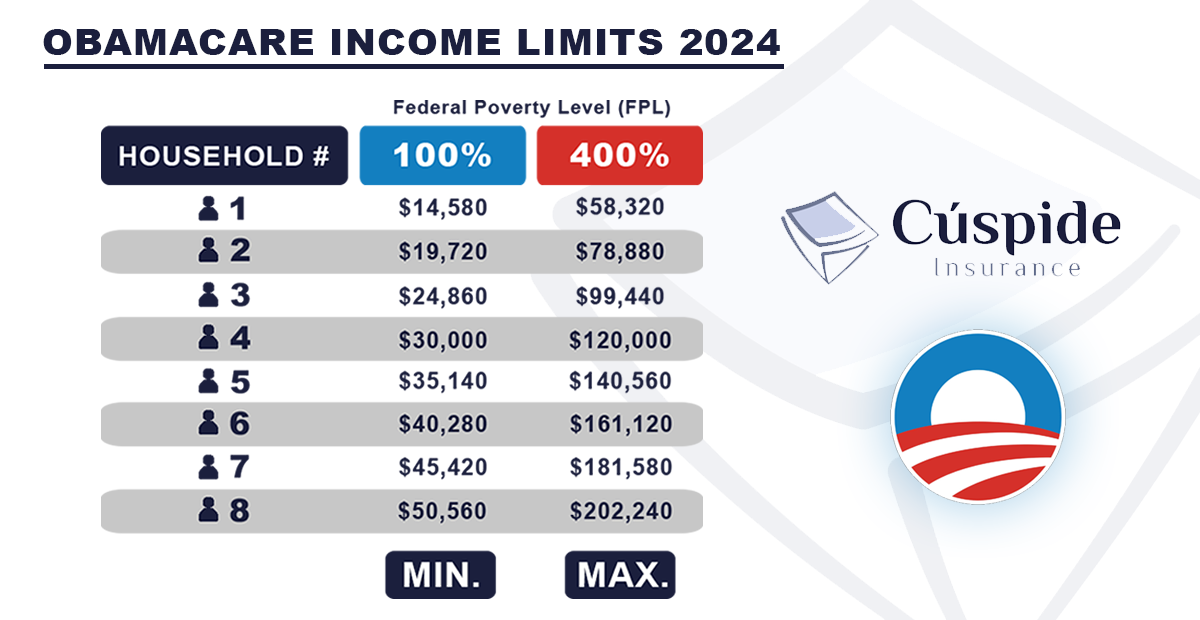

One important thing you should know is that your plan is all based on income. The less you make, the less your plan will cost and vice versa. As long as you meet the minimum income requirement then you can qualify to get coverage. Make sure you check out the income limits chart that we made to see if you qualify!

Our process here at Cuspide in getting you enrolled is simple:

1. We show you all the available plans in your area

2. Once you decide, we take the info needed and begin the application

3. Your plan is confirmed, and you are good to go

The good news is that usually students while in college are making low income and that means that you will most likely qualify for a free health plan. In general, 4/5 applicants qualify for a $0 a month plan.

Below is the income limits chart. It shows the minimum amount per household size to qualify and the maximum. It may look a little confusing but it’s not. We will breakdown the income eligibility that you must meet to apply for a health plan. If you are getting a plan through your college or your parents then don’t worry about this.

What is the minimum income requirement for students?

If you are not going to use the health insurance plan that your college offers, and you won’t be under your parent’s plan then you must meet the income requirement for a single person. Marketplace plans require that you make at least $14,580 for the 2024 year. That is $1,215 a month. As long as you make that, you can qualify for a plan through the health insurance marketplace.

That is just for one person. If you get married while you are still a student, then your spouse’s income will count as you will file for taxes together. Then, in the income limits chart you will use the minimum for 2 people, etc.

And on the rare occasion that you make more than the maximum limit that doesn’t mean you can’t apply. That just means you will pay the plan for what it’s worth and will not get any tax credit to help you pay for the plan (premium tax credit is what makes plan affordable for some.) Just think of it as the government helping you.

Now, let’s just say that you were eligible to apply and are ready to enroll. Let’s guide you through the marketplace and the many options available. Find out which one is best for you.

The best health insurance companies for students

You must know that in the ACA marketplace there are many plans to choose from. All these plans are offered by different companies. It’s important to note that location matters so there isn’t a universal answer as to which is best (they are all good) but, after running some tests we came up with the most consistent companies across many states. So, which one should you go with? Let’s get into it. In no order:

Oscar Health

Oscar is one of the newer companies but is already proving to be on top of the game. They are a good choice for students as they provide individuals and families with many low-cost health plans. Which is perfect for the struggling student life. They offer many plans with $0 deductible and copays.

PROS

– Affordable plans

– Usually $0 copays

– Plans with no referrals needed

CONS

– Available in only 21 states

BlueCross & BlueShield

One of the bigger names in the health insurance marketplace, they are a great choice because they offer many plans with $0 premiums. They are rated “A-“ in the AM Best Rating. They are one of the biggest companies, meaning they have a large network of care.

PROS

– $0 health plans

– Available in all 50 states

– Large network

CONS

– Coverage varies by state

Ambetter

This is also a great choice for students as they offer many affordable plans with great coverage. They have both EPO and HMO plans available for everyone to use. They received a 3 out of 5-star review by the official healthcare.gov website (which is good.)

PROS

– Affordable coverage

– $0 deductible and copays

CONS

– Only available in 27 states

As you can see all these 3 carriers are a good choice for college students. But guess what? Whenever you get quoted there is a good chance that none of these companies will appear and there will be another one that provides the affordable coverage you need. So, you don’t have to worry as they are all good!

Just be sure to find one that suits YOU. Some people want a plan that is just in case they need it. Others want a plan that will be used frequently. Depending on where you fall, you can pick one that is perfect for you. Do not try and pick a certain health plan because your friend has the same one!

Next steps for you

Now that you know how student health insurance works and the different types of options you can take to get covered, you are ready to decide. Figure out which of the 3 options you want to take (depending on your circumstances) and apply. Staying without coverage is not an option in most universities and it is not a good idea in case you need care. Remember there are many options for you!

From staying in your parent’s plan or getting a student health plan to getting your own plan through the health insurance marketplace. You can make sure that you are covered during your college days and can focus on what matters, your studies and your career.

Make sure you choose a plan that suits your needs and is specific to you. Our focus here is to make sure everyone gets affordable plans. With whatever route you go just know that you have help from us here at Cuspide.

About Cuspide

Hi, my name is Carlos, and I founded Cuspide in 2023. I have been an insurance agent for many years before that. Our focus here is to help everyone find the affordable coverage that they deserve.

If you contact us, you will mainly be speaking with me. We take pride in how we treat our clients. Unlike some others we help you even after the sale. Providing you with full support in things like finding doctors, making payments, and more.

We hope college students across the United States learned a little more about health insurance. Make sure to contact us if you have any questions or are ready to apply. Thanks for reading, enjoy your studies!

Found this article helpful? Share it!