There are many plans to choose from when it comes to Florida Health Insurance. But today we will focus on one of the most popular ones, Florida Blue (or BlueCross and BlueShield of Florida). Learn everything from cost and benefits to the pros and cons. Is it any good? Should you choose it?

This is your complete guide to Florida Blue Health Insurance. Let’s begin.

Key Takeaways

- More than 7 million Florida residents are covered by Florida Blue

- Florida Blue is the state’s leading health insurer

- Florida Blue has a rating of A+ on the S&P and an A on the A.M. Best

What is Florida Blue insurance?

Florida Blue is a health insurance plan that is offered by BlueCross and BlueShield in the state of Florida. They offer individuals and families with different types of plans like HMO, PPO, EPO and HDHPs (more on this later). On top of this they are the Sunshine states leading health insurer with over 52% of Floridians choosing them over other companies.

What type of insurance plans does Florida Blue offer?

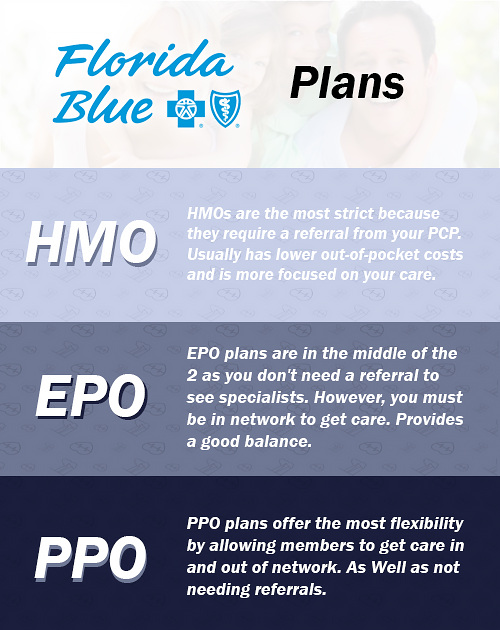

Florida Blue offers both HMO and EPO plans through the health insurance marketplace. There are a few differences between the 2 that you must know about so you can decide which one is for you.

Florida Blue HMO plans

The HMO plans (Health Maintenance Organization) that Florida Blue has, requires you to have a primary doctor (PCP) that looks over you. With an HMO plan, you will need a referral from them to see a specialist. Also, out-of-network care will not be covered (except in emergencies) and the network is a bit stricter. The good news is that HMO plans are cheaper than EPOs.

Florida Blue EPO plans

The EPO plans (Exclusive Provider Organization) under Florida Blue are more flexible but come at a higher price. EPOs are usually on in-network but sometimes they do provide coverage outside of your network. The key difference is that EPOs do not require a referral to see a specialist (you do not even need to assign a PCP). These are very similar to PPO (Preferred Provider Organization) plans if that is what you are looking for.

Bonus tip: Florida Blue also has HDHP plans (High Deductible Health Plans). If you want to save money, you can try to get a HDHP as these are usually much cheaper options.

Are Florida Blue and BlueCross the same company?

Yes, Florida Blue and BlueCross and BlueShield are the same company. Florida Blue is under the BCBS umbrella (BlueCross and BlueShield of Florida). They made the subsidiary in 1945 (16 years after BCBS was founded) and have been providing health coverage for Floridians ever since. Florida Blue is a health plan that was made by BlueCross and BlueShield that is just available in the sunshine state of Florida. This is usually tricky for some people because they offer both HMO and EPO plans with a slightly different name variation.

How do you get Florida Blue Health Insurance?

To enroll in a Florida Blue plan, you must apply through the health insurance marketplace with a broker or agent (like us at Cuspide). Keep in mind that plans are based on many different factors (age, location, income) so Florida Blue may not be the best choice for you. Also, it is important to check to see if you qualify! Call us today at (305) 970-8583 if you are interested in applying for Florida Blue!

Note: We are not the Florida Blue customer service department, but we can help with any questions or concerns that you may have as we are partnered with them.

Florida Blue Insurance Requirements

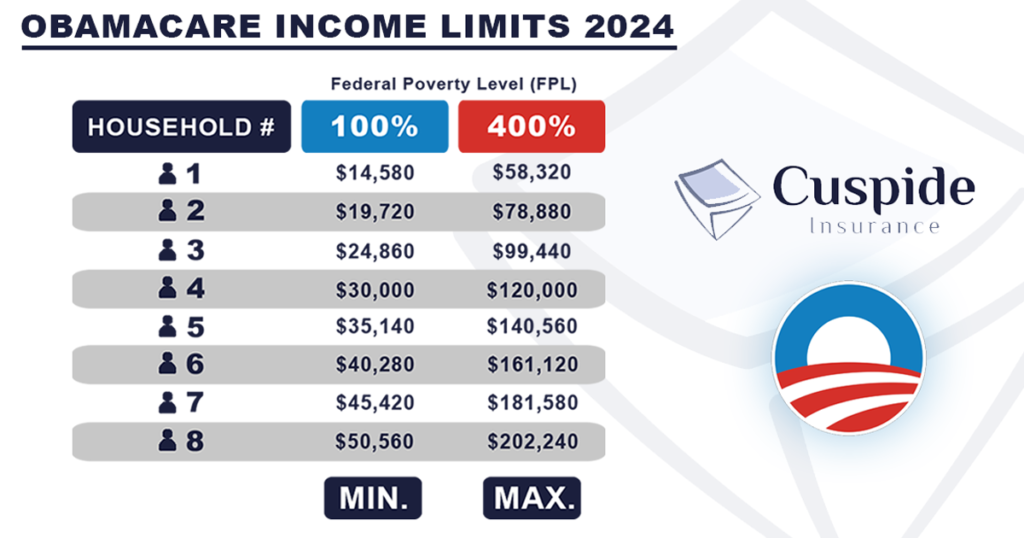

Just like any other Obamacare plans in the marketplace (ACA), you must meet certain requirements.

To qualify for Florida Blue, you must be a United States resident or citizen, never been imprisoned, and not have current coverage through Medicaid or your employer.

However, the most important requirement is the minimum income that is needed to qualify for ACA plans. Below is our Obamacare income limit chart that you can use to see if your income is enough to enroll in Florida Blue.

Income Limits for Florida Blue

Start by figuring out your household income (this will be the adjusted gross income). After, find out how many people that are in your household will be in your taxes. Because Obamacare is based on household income. For example, if you are the main tax filer and have 2 more people in your taxes, the income you need to make to qualify is $24,860 (minimum for 3 people). This is so you can get a subsidy for your health plan (premium tax credit) and pay less.

Florida Blue Plan Benefits

Like every other health insurance company, it is mandatory for Florida Blue to provide essential health benefits to their customers. Florida Blue insurance covers:

1. Hospitalization and emergencies

2. Prescription drugs

3. Doctor and specialist visits

4. Preventive care

5. Mental health services

Those are some of the services provided in-network (meaning doctors, facilities, hospitals) that accept Florida Blue. If you are out-of-network these services won’t be covered, except for emergencies. Also, keep in mind that these benefits are not free and will require copays or a percentage.

Florida Blue Health Insurance Costs

The average cost of health insurance in Florida is around $60 with a subsidy and $393 without a subsidy. This study was done on an individual with $30,000 of yearly income. Check back on the income limits chart to get an idea of what you will pay. Florida Blue plans tend to be the pricier option under Obamacare in Florida so keep that in mind. However, these are all just estimates, and this is not what YOU will pay. To find out how much you will pay for your Florida Blue insurance, contact us at (305) 970-8583 to get a free quote!

The Pros and Cons of Florida Blue

Before you hit that enroll button, let’s go over the good and the bad when it comes to Florida Blue.

Pros

- They have the largest network of providers in Florida, with many doctors, specialists, hospitals and more.

- Florida Blue offers many different types of plans like EPOs, HMOs, and PPOs. As well as many high deductible health plans (HDHP) for those wanting to pay less.

- Great care system in place with a focus on personal attention and things like preventive care & telehealth.

- Access to wellness and fitness programs for those wanting a healthier lifestyle.

Cons

- Florida Blue is one of the pricier options when it comes to plans in the health insurance marketplace.

- You will mostly need referrals to see specialists as mostly everyone goes with their HMO plans (their EPO plans tend to be expensive.)

Ultimately, when it comes to selecting a health plan in Florida, it is about your preference. If you have the budget and have the luxury of choosing, then it is up to you. Florida Blue is the most popular choice for Sunshine State residents wanting health coverage.

Florida Blue Insurance Reviews

Many of our clients have Florida Blue and they are all very happy. It is important before you choose a plan to see how other members are being treated and how their experience is like. We are going to base our review on 3 factors: member experience, pricing, and quality of care. Let’s go.

User experience

Florida Blue has a member portal which is where members go to make payments, find doctors, file claims, and more. Their user experience on their app and website is well made and easy to navigate.

Pricing

Florida Blue prices tend to be the most expensive option in the health insurance marketplace. They do have their HMO plans which are cheaper, but some people may be looking for EPOs (which are costly).

Quality of care

They are the best when it comes to care as they have a large network of providers working with them. You can expect amazing care when you are insured by Florida Blue.

Overall rating:

We give Florida Blue 4 stars total for the way they treat their members, their pricing, and user experience. If you are looking for health insurance in Florida, they are a great choice.

Should you get a Florida Blue plan?

This answer depends on many factors. Ultimately, the choice of the best plan for you depends on your needs. 90% of the time, everyone’s goal with health insurance is finding the most affordable option. And that is completely out of your control because location and income are huge deciding factors. In this case, if you really want a BCBS plan then go with a Florida Blue HMO as they are the cheapest option.

You should get a Florida Blue plan only if it is one the most affordable health plans that comes up in your area (price wise and plan-wise), otherwise it is better to go with other options. Our pro tip is to compare plans and pick one with the right balance of low deductibles and out-of-pocket max and premiums.

F.A.Q.

Cuspide answers some of the most asked questions regarding Florida Blue insurance. If you have a specific question or have any doubts, call (305) 970-8583!

To find out which doctor or hospital accepts Florida Blue you have to search through the member portal. This is where you can type which type of doctor you want to see and put in your zip code, and it will give you a list of providers that accept Florida Blue that are near you. Another option is to directly call the place you want to get checked at and ask if they take Florida Blue. Lastly, if you have the right insurance agent (like us at Cuspide) they will be able to help you to find a doctor that accepts your insurance.

Yes, Florida Blue may be the best health plan in Florida but only to some. Health insurance plans are based on income, age, location and household size so that means that there are lots of factors that go into the pricing. For example, if by best plan you mean the cheapest, then Florida Blue is not that. They do have great coverage because they have many types of plans and have the largest network in the state of Florida. More than half of the state is insured by Florida Blue. To find out if it is the best for you, call (305) 970-8583.

Florida Blue plans start at $0 a month but are some of the most expensive options in Florida. You can expect your Florida Blue plan to cost you anywhere from $10 to $100 a month with a subsidy and around $400 without a subsidy. What you will pay in monthly premiums is based on your income, so the more you make, the more you will pay for your health insurance. To find out what you will pay, contact Cuspide Insurance and we will get you a quote at no cost to you!

Yes, Florida Blue has many dental plans to choose from. After applying, members will have an option to add dental coverage at an additional cost. Only some plans will have this, and it will be a little more expensive. Think of it like a small supplementary option that it has. Florida Blue dental plans will cover routine services such as cleanings, exams, X-rays, and fillings. These dental insurance plans may also cover more extensive procedures such as root canals, extractions, crowns, bridges, and dentures. Contact Cuspide to learn more!

Enroll in Florida Blue Health Insurance today

To sum things up, Florida Blue is the leading healthcare provider in the Sunshine state. And now that you know more about them, it is time to take the next steps and enroll in a plan. If you apply with us, the process is easy and quick. We are a health insurance agency based in Miami, FL and have been in the industry for a long time. Contact us today at (305) 970-8583 for everything health insurance!