If you have been wondering about getting Oscar Insurance in Florida, then you have luckily come to the right place! While there are many insurance companies in the sunshine state today, we will be focusing on the new kid in the block.

Learn everything you need to know like type of plans, benefits, costs, and more. This is great for those who want to know more and decide before buying or switching.

Consider this as your complete guide to Oscar Insurance in the state of Florida. Let’s begin.

Is there Oscar Insurance in Florida?

Yes, Oscar offers health plans in the state of Florida. They joined the FL marketplace back in 2023 and have been one of the top insurers in the sunshine state. Companies operate by offering different plans in certain states and counties. In the state of Florida, Oscar has a great variety of plans and tiers available for people to choose from.

What type of plans does Oscar Insurance offer in Florida?

As of 2024, Oscar is in 18 states and throughout all of them they offer Health Maintenance Organization (HMO), Exclusive Provider Organization (EPO), and Preferred Provider Organization (PPO) plans. However, in the state of Florida, Oscar Insurance only has EPO plans available.

Aside from that they also offer catastrophic plans as one of the tiers alongside the normal metal tiers like Bronze, Silver, and Gold. Let’s break it down.

EPO Plans

In Florida, Oscar insurance offers Exclusive Provider Organization (EPO) plans. With this type of plan, you will have more flexibility than your standard HMO and if you need to see a specialist, you will not need a referral from your PCP.

For every tier their plans have 3 different names: Classic, Simple, and Elite. Oscar plans will look like this:

- Bronze Classic

- Bronze Simple

- Bronze Elite

- Silver Classic

- Silver Simple

- Silver Elite

- Gold Classic

- Gold Simple

- Gold Elite

Each of these differs slightly in terms of copays, deductibles, and out-of-pocket maximums. If you want to know which one to go with that will depend on your area, income, age, and household size.

Catastrophic plans

Oscar catastrophic plans are high deductible plans that are designed to cover you in case of worst-case scenarios. They will have the lowest premiums but the highest cost when it is time to receive medical care. Also, it will only be available to those under 30 and on a low enough income.

What will Oscar cover?

Like any other company in Obamacare, Oscar must cover the 10 essential health benefits for their members. While all these services are covered, what you end up paying for these will depend on which type of plan you choose.

- Doctor visits

- Emergency services

- Hospitalization

- Maternity/newborn care

- Prescription drugs

- Mental health services

- Rehabilitation

- Laboratory services

- Preventive care

- Pediatrics

Also, if you choose an Oscar plan, they have other benefits like telemedicine services, virtual appointments, and much more through their member portal. Some Oscar plans include dental and vision.

What hospitals accept Oscar Insurance in Florida?

Like previously stated, coverage of health insurance companies is based per state and more so per county. It could be possible that Oscar is in your state but not in your county. So, which doctors and hospitals are accepted by Oscar?

As of 2024, Oscar insurance is in 34 counties in the state of Florida. They are below:

Alachua

Bay

Brevard

Broward

Citrus

Clay

Columbia

Duval

Escambia

Flagler

Franklin

Hernando

Highlands

Hillsborough

Indian River

Lake

Leon

Manatee

Marion

Miami-Dade

Okaloosa

Okeechobee

Orange

Osceola

Palm Beach

Pasco

Pinellas

Polk

Santa Rosa

Sarasota

Seminole

St. Lucie

Volusia

In each of these counties they accept many hospitals and doctors to choose from. You can find the 2024 list of providers here.

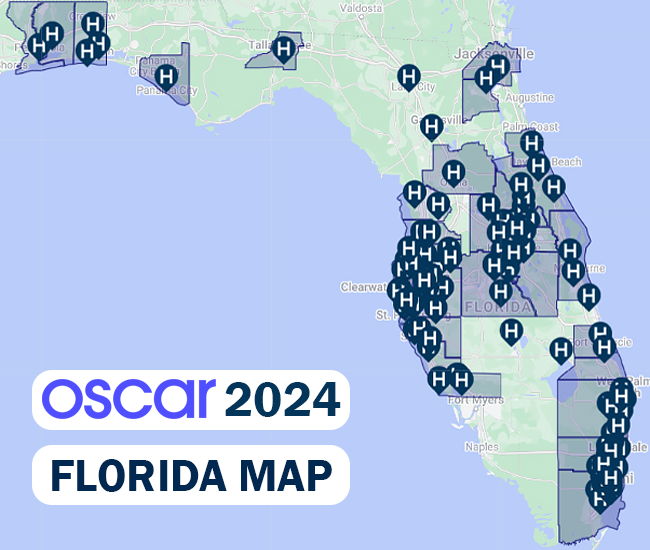

Oscar Insurance Company of Florida coverage map

Pros and Cons of Oscar insurance in Florida

Like everything, Oscar plans will have their good and bads. Let’s compare so you can get an overall better idea of what to expect.

PROS

- One of the lowest rates for Obamacare in Florida.

- Virtual doctor appointments.

- Rewards for their members.

- The best user experience through their website/app.

CONS

- On the higher end of complaints from customers.

- Low rating from the National Committee of Quality Assurance (NCQA

- Limited areas of coverage throughout Florida.

Oscar Insurance Company of Florida reviews

While reviews depend on the person individually and their experience, it is safe to assume that the consensus is that Oscar is rated at an average of 3 out of 5 stars. This is determined by thousands of reviews, the NCQA, BBB, and AM Best Rating, as well as much other research.

Below are some of the most reputable sources and what they give Oscar out of a 5-star rating:

Forbes Advisor: 3.2/5 stars

NCQA: 2.5/5 stars

Blueprint: 3.5/5 stars

BestCompany: 3.3/5 stars

Here at Cuspide we agree with these ratings and would give Oscar a 3.5 out of 5 stars overall. While it has mixed reviews, in the state of Florida, it’s certainly one of the leading insurers and provides great coverage.

Where does Oscar Insurance rank in FL?

Of course, Oscar is not the only health insurer in the Florida marketplace. How do they rank in comparison to all the other insurers? To see where they rank overall in the Sunshine State, check out our top 5 health insurance companies in Florida list. Learn about the other companies and how they differ.

How much does Oscar insurance in Florida cost?

In the state of Florida, you can expect to pay around $519 a month for an Oscar plan without a subsidy. Overall, in terms of price, they rank around average. This also depends on what kind of plan you choose and what tier (Bronze being the cheapest and Platinum being the most expensive).

Also, most Floridians will qualify for a subsidy or premium tax credits which will end up lowering their monthly costs down. For example, the average client here at Cuspide pays only $40 a month. Since there are lots of factors that go into pricing, don’t base your purchase off averages.

Contact Cuspide at (305) 970 8583 to enroll in Oscar. Save money on your health insurance!

The bottom line

Overall, Oscar can be a solid choice when it comes to getting health coverage. Before you decide on just one company, make sure to compare all the plans available in the Florida marketplace. There are 10 or more health insurers in the sunshine state so do not go with the first one you see.

Find out your needs and you can go from there. However, if you are looking for affordable plans that offer flexibility then Oscar Insurance Company of Florida may just be the choice for you.

Share